What Restoration Services are Covered By Insurance?

Posted in Mold Removal, on October 24, 2014

Having any sort of damage to your house can be stressful and costly. Understanding what insurance will and won’t cover can be make a huge difference. Additionally, determining whether putting a claim through is worth it. Depends on individual deductibles, how many claims one has made already. This all affects whether the insurance company will renew your policy or change your premiums. In many cases the cause of damage may be lower of your deductible or just slightly above which wouldn’t make sense putting a claim through at all. So are all water damages covered? Unfortunately not. First, major factors is the coverage of the insurance plan. Does it include burst pipes, sewage back-ups, etc…? Most plans do not coverage seepage (water entering through window cracks or foundation) unless additional coverage was purchased. Was the cause a natural act that no one could have prevented, or was the homeowner negligible for causing harm to a pipe? Was the cause due to an act of god such as a flash flood?

All of the factors determine whether your insurance policy is covered for the damage or not. Additionally, home insurance policies cover damages caused machine that overflows, leaking water tanks or broken main water pipe). During the floods that occurred across the nations (Calgary and Toronto, Burlington being the major ones) many homes were stranded with standard water in their basement without any coverage. Expenses can add up to larger than 20-30 thousands (depending on the size of the property) with limited/ no coverage.

Water Damage & Mold Removal in Toronto

One of the worst results of water damage in Toronto can be mold. Mold generally is not covered in by insurance on its own. So if you find mold growth in your basement, or bathroom, no need to call your insurance agent. However, should you have a broken pipe (which is covered) which caused the mold growth, the remediation can be covered. Many instances where long-term neglect of the up keeping of your home and condition, mold will not be covered. It is vital to speak with your insurance agent regarding you individual policy and what is included in it. Mold damages properties and cause health problems, especially those with asthma or weak immune systems as such, it requires immediate mold removal in Toronto. The best way to prevent mold, is by controlling indoor moisture. By doing this you can eliminate mold growth that forms on damp areas.

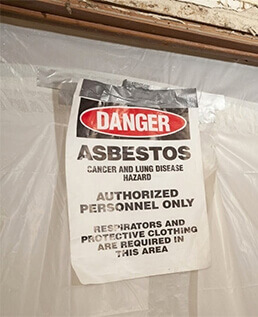

Some examples of this are in bathroom walls, basements, attics. Hiring a profession restoration company which is experienced is best course of action to remove it. Another major concern that our company gets questions is whether asbestos is covered by insurance. However, asbestos is not covered by insurance and in every policy has exclusions where certain conditions or situations are not included in the policy. Asbestos became a more common exclusion once the true affects became known in the 80’s. After many deaths and lawsuits, insurance started to exclude asbestos coverage. So should you find any asbestos in your home, following the same course of action as mold, call a professional. Look for experience, certification and proof of insurance.